Daily NAV REITs Post Third Straight Quarter of Positive Returns

Summit Investment Research, a research and due diligence firm founded by Michael Stubben, recently released its dNAV REIT Index report for the fourth quarter of 2016 which compares quarterly returns of daily NAV real estate investment trusts over the last three years.

Daily NAV REITs are not actively traded on a market and typically have lower volatility than listed REITs, but they also have lower returns due to their higher front-end and on-going fee structures, according to the report.

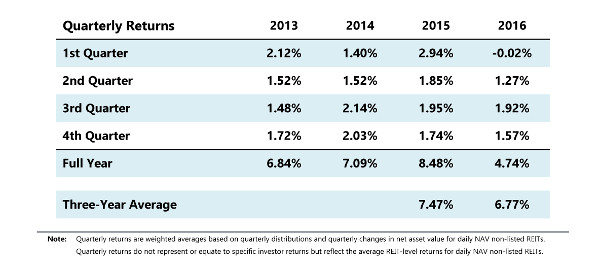

During the fourth quarter of 2016, daily NAV REITs posted returns of 1.57 percent, which is the third straight quarter of positive returns after reporting a -0.02 percent return in the first quarter of 2016.

Summit noted that the REITs had a weighted average 1.03 percent quarterly distribution rate and average 0.54 percent increase in net asset values in the fourth quarter.

During 2016, the total return for daily NAV REITs topped 4.74 percent, comprised of 4.05 percent in distributions and 0.69 percent in appreciation (NAV growth). This was the lowest return in three years, which Summit noted was primarily the result of low market cap rates from seven years of cap rate compression and rising interest rates on debt financing.

For the three years ended December 31, 2016, the Summit dNAV REIT Index reported a 6.77 percent average annual return. During the same three-year period, the FTSE NAREIT All Equity Index reported a 12.91 percent average annual return for listed equity REITs, which Summit noted have significant volatility.

Summit Investment Research has been active since April 2016 and covers non-traded REITs, business development companies, interval funds, and listed REITs (that acquired non-traded REITs or were once non-traded). The company’s research can be utilized by a variety of industry clients including financial advisors, registered investment advisors, broker-dealers, sponsors, service providers like law firms, due diligence firms, industry organizations, and news organizations, and institutions.