Guest Contributor: Generating Alpha Without the Volatility

whip·lash /ˈ(h)wipˌlaSH/- ‘a jerk or jolt suddenly, typically so as to cause injury’.

Almost everyone reading this article has experienced whiplash at some point in time and it doesn’t feel good. The punishing daily valuation roller coaster of the stock market saps confidence and raises serious questions if we are at the top of the market.

Last month, I wrote an article titled ‘Private Equity – Where The Bulls Can Run For Cover’ where I discussed how the stock market was ‘priced for perfection.’ The cracks in the foundation had already started to show themselves at that time and now we are starting to see the aftermath as the stock market has siphoned off hard earned gains created over the past few years.

The current market conditions, and significant volatility, raises serious questions regarding valuations and the overall outlook for public equities. One thing is certain, at today’s valuation levels the market will continue to produce additional volatility due to seemingly nominal issues such as China’s economic woes and tiny Greece’s debt. It’s difficult to make sound investment decisions in the stock market in the face of such uncertainty.

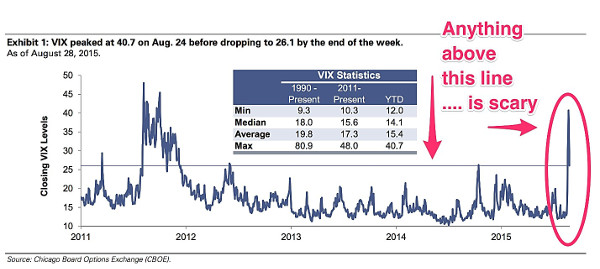

The topic of volatility in public equities has not been top of mind for investors in recent years, but should be following recent market events. One of the primary measures of volatility is the VIX index (an index calculated by the Chicago Board Options Exchange which measures the implied volatility in S&P 500 index options). While volatility itself is not a measurement of economic performance, it does signal the level of investor uncertainty and has been a strong indicator of recessions. Average VIX levels in the recessions of 1990 and 2001 were 25 and 26, respectively. The worst was of course 2008-09 where the VIX was 34. As highlighted below, recent volatility peaked at 40.7 on August 24th and is currently at 26.

While the US economy appears to be in solid shape and most investors feel good about the future prospects for American companies, public equities are greatly influenced by uncorrelated capital flows driven in part by the risks of global contagion resulting from global events.

The problem most advisers face is the need to keep their clients’ money working for them and importantly the need for ‘alpha’ during a flat or down market. There is an alternative to investing in publicly traded companies. Quite simply, it’s investing in privately held growth-oriented companies, predominantly tied to the health of the U.S. economy, underwritten and professionally managed by private equity managers. Institutional investors have relied upon private equity funds and hedge funds for years as a way to balance the inherent risks from being fully tied to public equities. These professional investors have been increasing their allocations to both alternative investments and more specifically private equity.

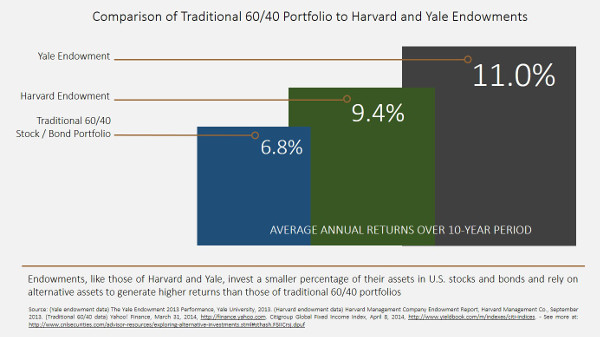

As shown below, arguably some of the savviest university endowments in the country have demonstrated that they can outperform traditional stock and bond portfolios over time and have done so with far less day-to-day volatility. But that’s not the entire story. If you peel the onion back, you will see Yale’s superior performance is not only a function of having a larger allocation to alternative investments, but their decision to have their largest allocation (33 percent) of their investment portfolio in private equity. In fact, the 2014 Yale Endowment Report states “the heavy allocation to nontraditional asset classes stems from their return potential and diversifying power.” and continues “private equity offers extremely attractive long-term risk-adjusted returns…” In comparison, Harvard’s Endowment allocated 18 percent of their portfolio in 2015 to private equity, which, while less than Yale, still represents the largest single asset class allocation for the university’s endowment.

There are approximately 3,300 U.S. based private equity firms in existence. However, few of them are accessible to individual investors and those that are available typically have very high minimum investment requirements. The recent advent of private equity funds, such as Triton Pacific Investment Corporation, has further ‘democratized’ access to institutional quality private equity funds. With widely accessible funds like this, savvy advisers now have access to alpha without the volatility.

Click here to read Craig Faggen’s recent article, Private Equity—Where the Bulls Can Run for Cover.