Stanger: Are We There Yet?

The following special report was issued by Robert A. Stanger & Co. and reprinted with permission

These backseat words are typically the bane of every parent taking the kids on a summer vacation in the family van or SUV. But increasingly they are also being heard at the watering holes and in the executive suites of the movers and shakers in the non-listed REIT, non-listed BDC, and direct participation program industry. Unfortunately, the destination in question is not DisneyWorld or the beach – it is the nadir of industry fundraising. And, based on April fundraising, it appears that the industry has not yet arrived at that low point.

Overall DPP fundraising has been on a downward trajectory for over three years, falling from a record $24.5 billion in 2013 to approximately $6.4 billion in 2016. The decline did not reflect a repudiation of the investment environment for the asset classes and industries DPPs operate in. Rather, regulatory change (FINRA’s amendments to the account statement rules), the introduction of new product structures (multi-share class non-listed REIT products) and regulatory uncertainty (the form and impact of the Department of Labor’s fiduciary rule) all contributed to the decline.

Despite this “recession” in DPP fundraising, 2017 began with an expectant air of optimism (akin to the unjustified optimism parents feel when the kids and supplies have been loaded and the van hits the open road). The account statement rules had been in effect for over eight months, financial advisors were becoming more fluent with, and accepting of, the new share class structures, and preparations for the implementation of the DOL fiduciary rule were well along at most broker-dealer firms.

Moreover, a major international real estate investment manager, Blackstone, had successfully introduced an NAV REIT in three wirehouses, and in so doing broke through a 30-year moratorium on the sale of retail non-listed real estate products on Wall Street. Surely, the DPP industry had survived the downhill ride, seen the bottom, and was poised to move back up the curve.

Not so fast. So far in 2017, the uncertainties have only compounded: the ultimate fate and final form of the DOL fiduciary rule; the impact on inflation, interest rates and economic growth of the Trump administration’s fiscal and monetary policies; prospective legislative and regulatory changes affecting the financial services industry; prospective capital market reactions to international events; the potential winners and losers post-tax reform; and…let’s see …. is there anything else we can pile on to the list of uncertainties….yes….the country’s national debt clock is ticking.

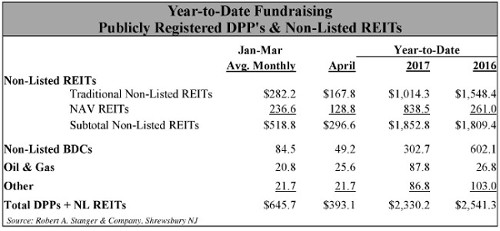

The result of this logjam of uncertainty appears to be continuing paralysis among broker-dealers and financial advisors who recommend DPP products. Fundraising in April totaled only $393 million. The pain was felt in both major categories of DPP investment. Non-listed REITs raised $297 – the lowest month since August 2016. But what is most telling is that this low monthly fundraising included $105 million of sales of the Blackstone NAV REIT through the wirehouse channel. Excluding that new distribution channel, April fundraising for non-listed REITs in the independent broker-dealer channel was only $192 million – the lowest monthly total in over 15 years.

The news is no better for non-listed BDCs, which raised only $49 million in April – the lowest monthly sales since November of 2010 when the product was still in its infancy in the IBD channel. Year-to-date, non-listed BDC fundraising is down almost 50 percent versus the same period in 2016.

Without a cure for the paralysis and an uptick in these sales rates, 2017 fundraising, even with wirehouse distribution of DPP products, is unlikely to surpass 2016 fundraising by a meaningful amount. The implications for the continuing integrity of distribution platforms, sponsor organizations, and broker-dealers are not pretty.

Are we there yet? Are we at the bottom? On those childhood road trips, our beleaguered and frustrated parents would say: “Shut up and sit down.”

Our advice is similar: “Stay tuned and put on your seats belts.”